Just few steps to plan and manage your cash-flow

Cash-flow management starts with a precise cash-flow planning…

…and continues with the controlling of expenses and incomes.

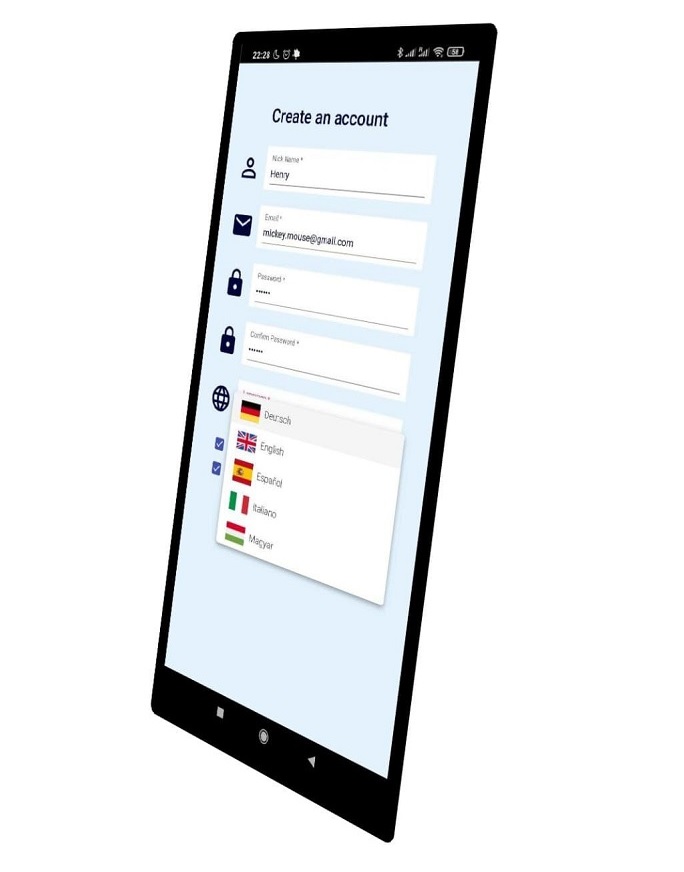

Step 1: Register

It is absolutely safe because:

- No personal data are required

- No bank credentials are required

- Just a nickname and any e-mail address will do

The first three month is free!

Check our pricing policy

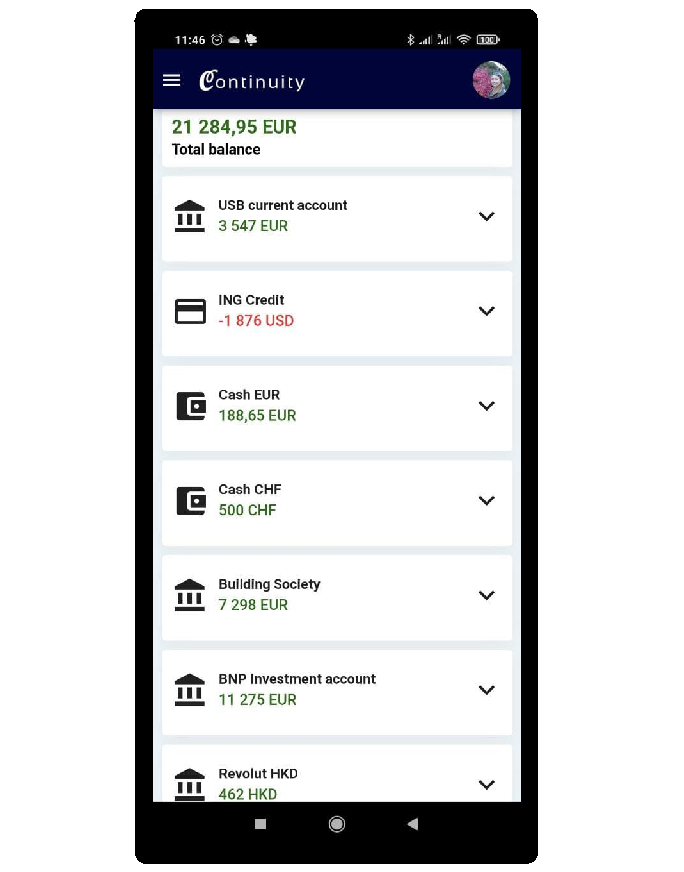

Step 2: Define your accounts

When you are specifying your accounts

- You can assign them different account types and

- They can use different currencies

Follow the tooltips!

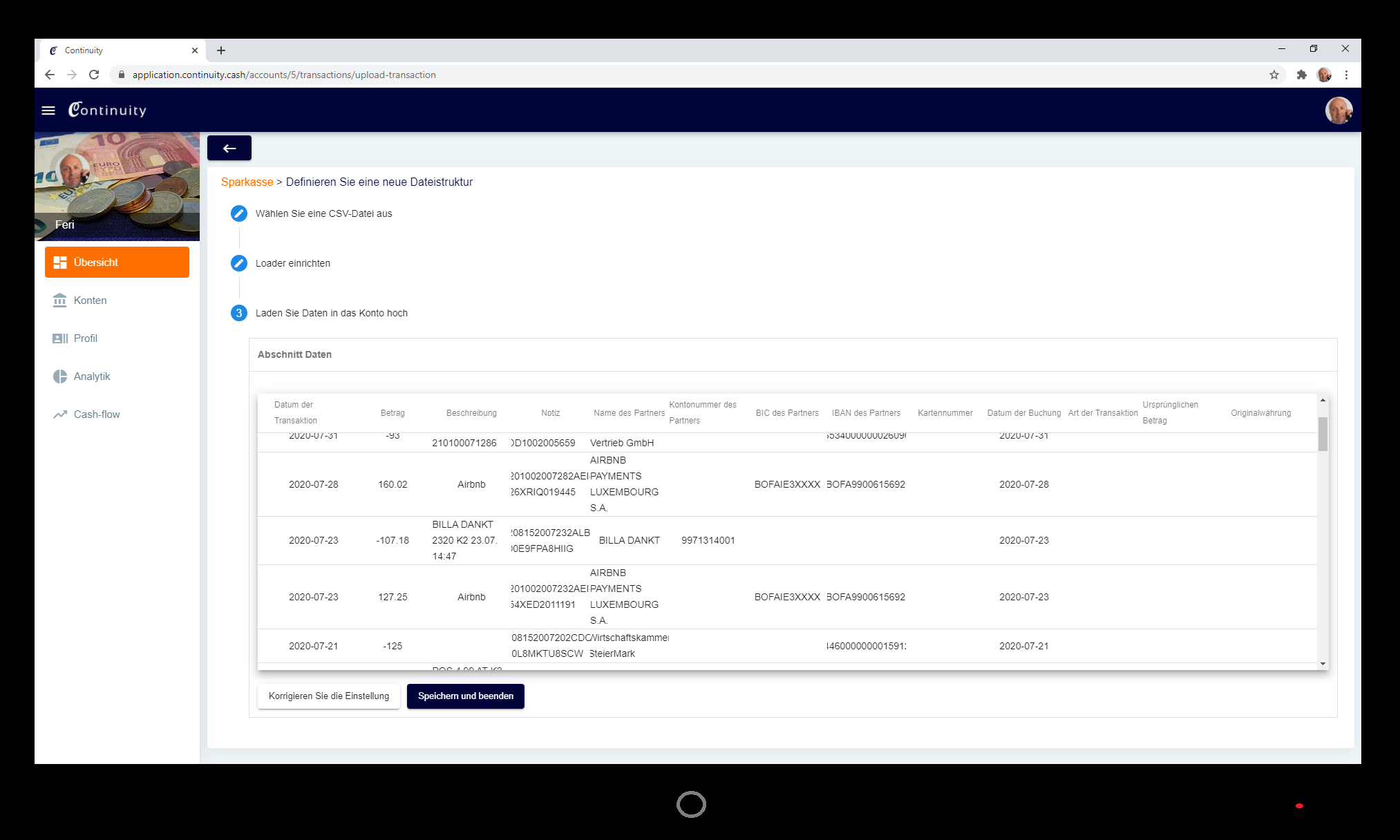

Step 3: Upload your transactions

- Export your data from netbank in csv format

- Define the columns and formats. You have to do it only once

- Continuity will remember your settings at future uploads

Moreover the system in the background checks for the regularities and recognizes them automatically. By using this information plans and inserts future transactions.

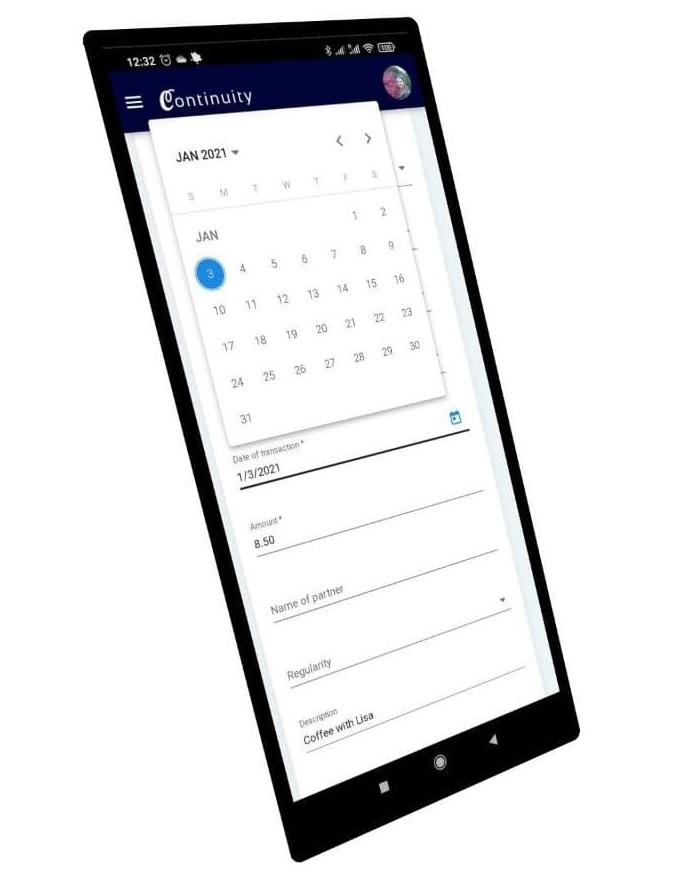

Step 4: Enter your spending

- Select the date of the transacion

- Enter the amount

- Write some note to remember

- Select the regularity of the transaction

You can enter your transactions immediately on your mobile.

This correct entry of your transactions is the basis of the excellent cash-flow planing and csah-flow management.

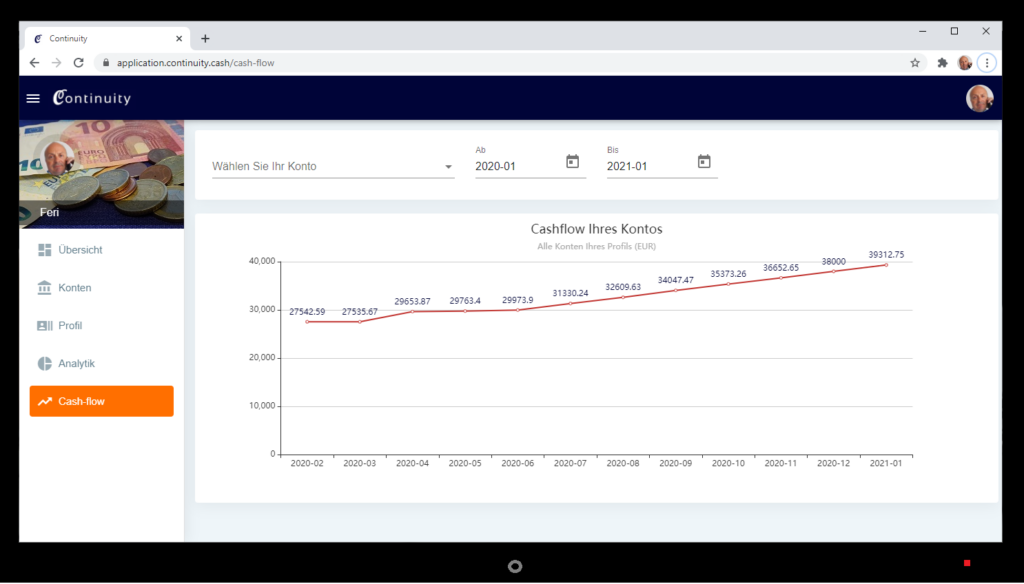

Step 5: Check and manage your cash-flow

Continuity generates you a cash-flow plan for one year in advance. This works so that the application automatically recognizes the regularities and calculates based on this.

If you recognize a negative balance in the future then you still have time to correct it. In order to manage your cash-flow you can intervene by:

- postponing some expenses,

- getting some payments in advance or

- transfering some money from another account.

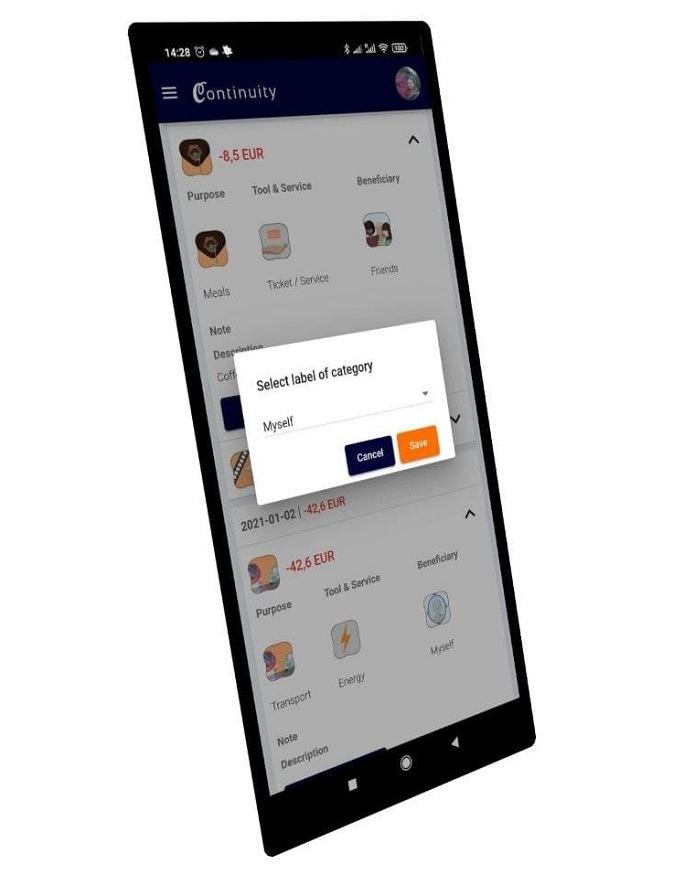

Step 6: Categorise

For expenses you can find three “dimensions”:

- Purpose

- Tool & Service

- Beneficiary

On the other hand for incomes there are two “dimensions”:

- Title

- Paying

What if you move money between your accounts? That is neither expense nor income. It is just a transfer.

After few entries the system will recognize your rules. Therefore it will be able to do a customized categorization for you automatically.

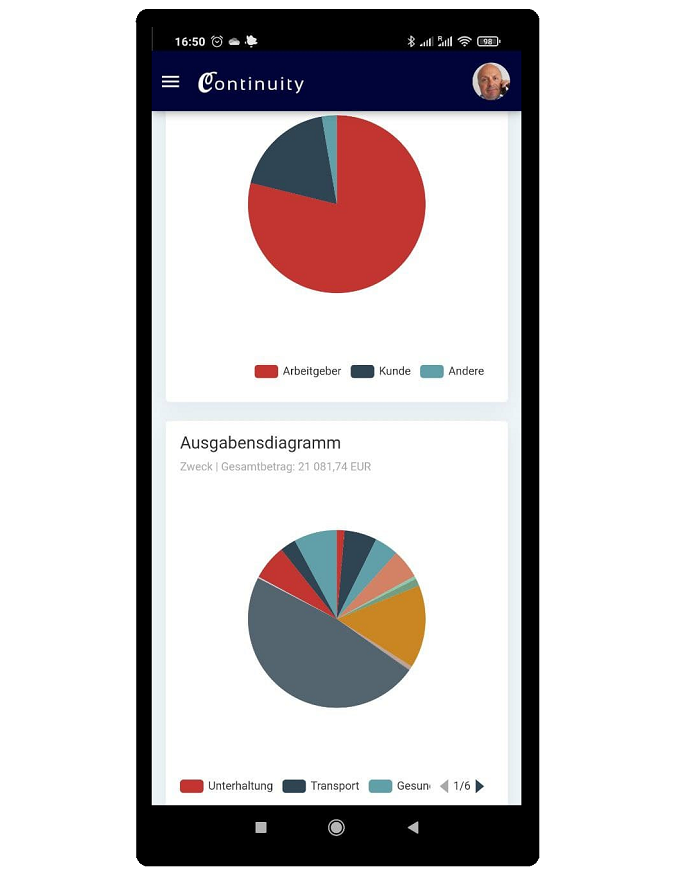

Step 7: Analyse your expenses and incomes

You can do it:

- by categories and

- by time periods

Because you can manage only those things what you control!